Cask Investment

- Unlock the potential of Scotland's most sought-after distilleries with our exclusive Whisky Asset Management service, specialising in new and rare whisky casks.

- Learn more about purchasing Whisky Casks:

Invest in the world's fastest-growing alternative asset class with Speyside Capital's Scotch whisky cask investment.

Our highly experienced team works with clients to build fully diversified portfolios of exclusive casks perfectly aligned with their risk appetite and broader asset base.

Cask whisky investments can be purchased with multiple distilleries allowing investors to build balanced portfolios.

Cask whisky management involves acquiring, ageing, and selling whisky casks as investments. The process typically starts with acquiring whisky casks from a distillery, often at a young age. The casks are then stored in bonded warehouses for years to allow the whisky to mature. During this time, the whisky is periodically sampled and tested to ensure it ages correctly and determine the optimal time to sell the cask.

Once the whisky has reached its peak maturity, the cask can be sold to investors looking to add alternative assets to their investment portfolios or to independent bottlers who regularly source aged casks for new Single Malt whisky releases.

The whisky industry produces and sells whisky to distributors and consumers worldwide, with a portion of the production earmarked for cask whisky management. Distilleries, brokers, and independent bottlers are responsible for sourcing and ageing whisky casks, and they work with alternative asset managers like Speyside Capital to bring these investments to market.

The value of whisky casks is determined by various factors, including the age and quality of the whisky, the distillery where it was produced, and the overall market demand for whisky investments. Rare and limited-edition casks can command incredibly high prices at auction and are highly sought after by collectors and investors alike.

Cask whisky management offers an exciting investment opportunity for investors looking to diversify their portfolios and potentially generate strong returns. With the guidance of an experienced alternative asset manager like Speyside Capital, investors can access some of the world’s most desirable and exclusive cask whisky investments.

Benefits

- Capital gains tax free investment

- Tangible asset in your name, enjoy full ownership

- Professional advise to avoid common pitfalls

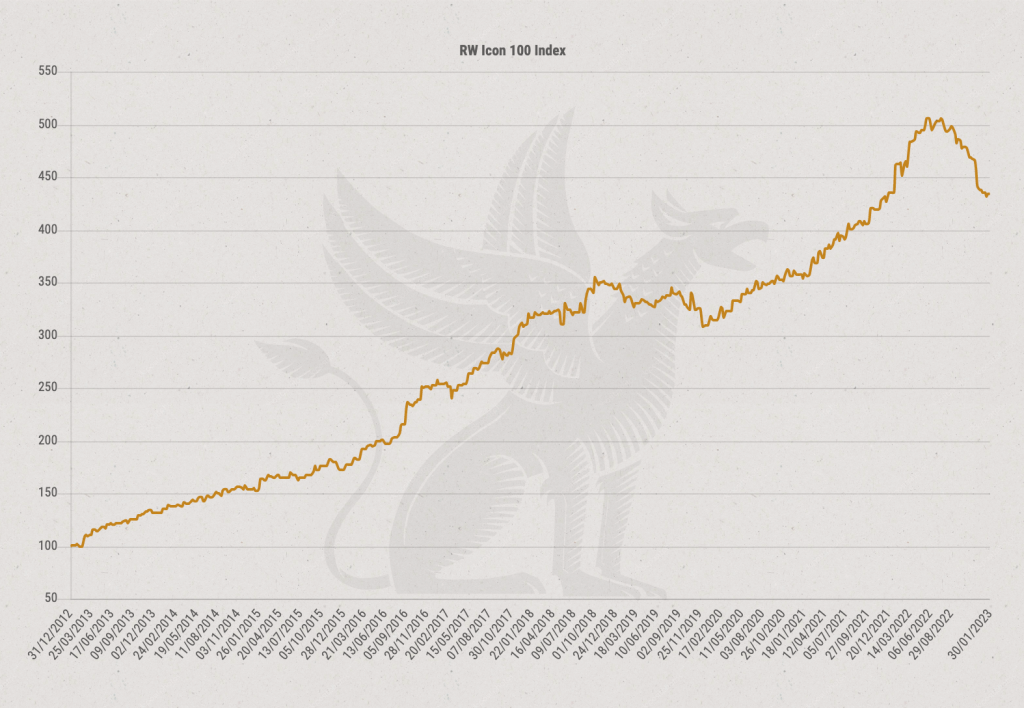

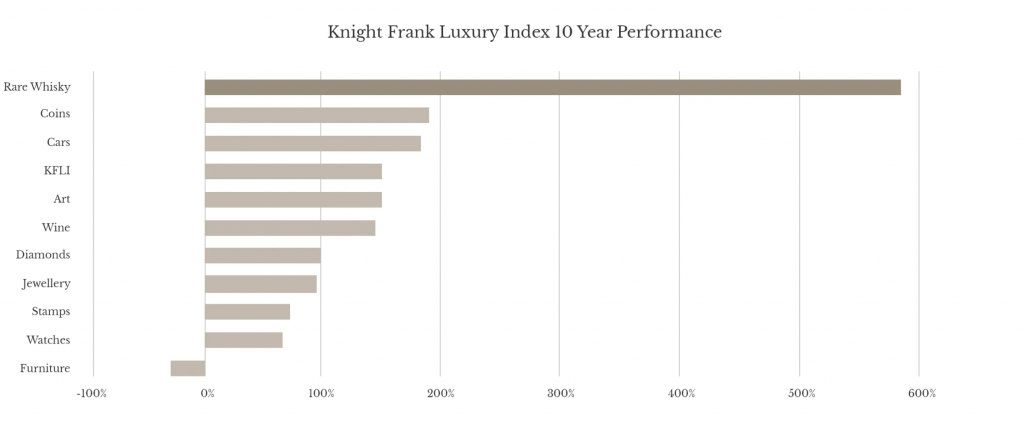

Whisky is proven to be the best performing alternative asset of the decade.

Invest in the biggest and highest-value distilleries in the industry with Speyside Capital

Bottles and Casks from these distilleries, as well as rare and limited-edition releases, can command incredibly high prices at auction and are highly sought after by collectors and investors.

Whisky Cask Portfolio

Premium cask investment in new or aged single malt Scotch whisky casks at wholesale rates.

Key Benefits

- Best performing alternative asset

- Capital gains tax free investment

- Tangible asset in your name

- Managed portfolio

Whisky Bottle Portfolio

Complement your portfolio with collectable pre-bottled whisky sourced from Scotland’s 140 distillers and over 40 exclusive independent bottlers.

Key Benefits

- Individual bottlings or collections

- Buy and hold strategy

- Outperform the stock market

- Rare and exclusive bottles

Diversified Portfolio

Truly diversify your portfolio with a carefully constructed diversified portfolio of Casks and bottles from multiple distilleries and bottlers.

Key Benefits

- Matched to client risk tolerance

- Risk- balanced Portfolio

- Outperform the stock market

- Low volatility growth curve

Discover Whisky Cask Ownership and Investment

How This Works

Purchasing Whisky Casks with Speyside Capital is easy.

- Join our online portal

- Reach out to us

- Receive your tailored Cask portfolio

- Digitally Onboard

- Watch your investment grow

Discover Your Options

Join our Online Learning Portal For Free

- Complimentary 30 Minute Webinar

- Educational Videos

- FAQ's

- Cask Portfolio Examples & Distillery Access

- How This Works