Why Whisky Investment

- Exploring Whisky Investment Options: From Casks to Collectible Bottles

- Learn more about purchasing Whisky Casks:

Enjoy strong returns, diversification and hedge against inflation with a well-rounded Whisky investment portfolio.

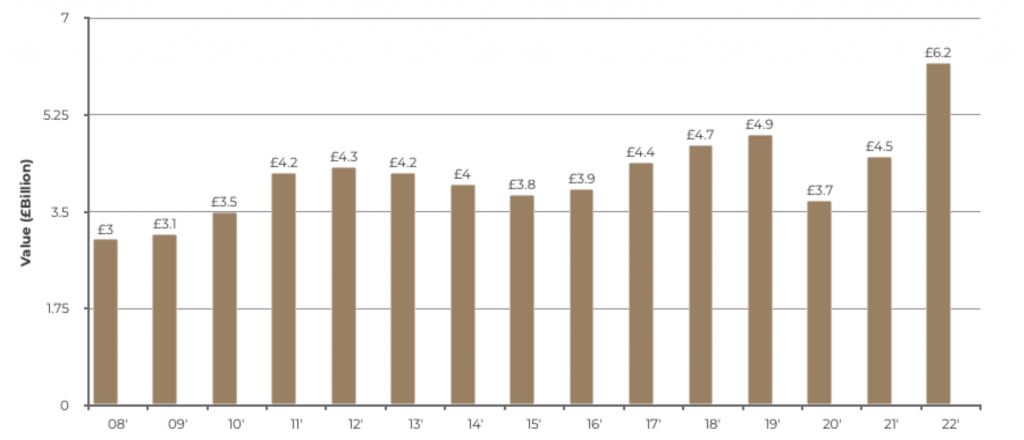

Scotch Whisky casks and bottles have shown impressive growth in recent years. According to the Knight Frank Luxury Investment Index, rare Whisky was the top-performing luxury investment category.

Investor Benefits

- Capital gains tax free investment

- Tangible asset in your name, enjoy full ownership

- Enjoy generous annual returns on your investment

- Casks stored for you in a WOWGR registered warehouse

- Insurance provided

- Dedicated Portfolio Manager to help avoid common pitfalls

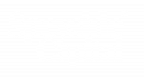

Whisky is outpacing the growth of traditional investment assets such as stocks and bonds.

Investors perpetually seek avenues for enhanced returns with minimal risk. Over the last decade, whisky has demonstrated superior performance compared to conventional assets like stocks and bonds. It not only enjoys robust demand but also stands out during periods of economic uncertainty.

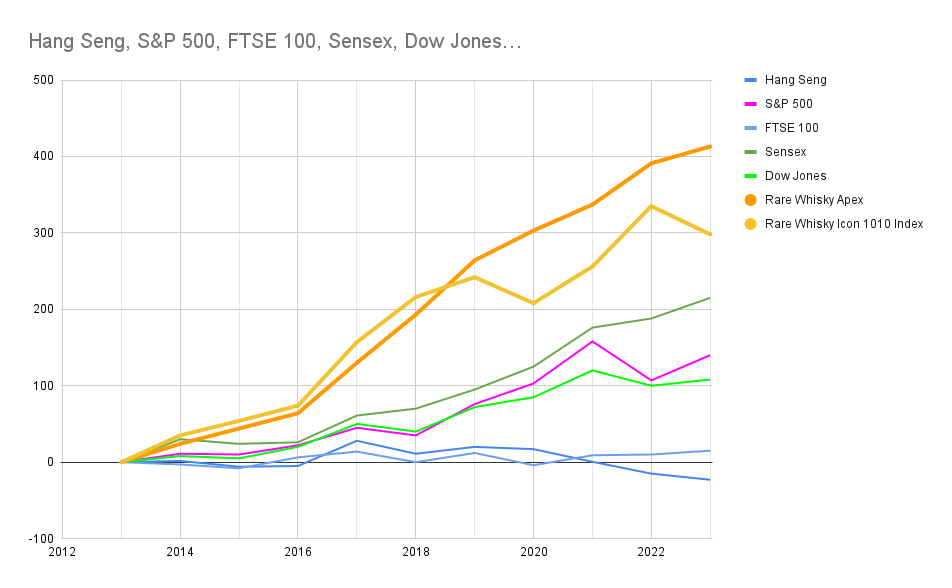

Surging Demand

In 2022, the value of Scotch Whisky exports was up 37% by value, to £6.2bn with the number of 70cl bottles exported also growing by 21% to the equivalent of 1.67bn.

Whisky is proven to be the best performing alternative asset of the decade, and shows no signs of slowing down.

Whisky Cask Portfolio

Premium cask investment in new or aged single malt Scotch whisky casks at wholesale rates.

Key Benefits

- Best performing alternative asset

- Capital gains tax free investment

- Tangible asset in your name

- Managed portfolio

Whisky Bottle Portfolio

Complement your portfolio with collectable pre-bottled whisky sourced from Scotland’s 140 distillers and over 40 exclusive independent bottlers.

Key Benefits

- Individual bottlings or collections

- Buy and hold strategy

- Outperform the stock market

- Rare and exclusive bottles

Diversified Portfolio

Truly diversify your portfolio with a carefully constructed diversified portfolio of Casks and bottles from multiple distilleries and bottlers.

Key Benefits

- Matched to client risk tolerance

- Risk- balanced Portfolio

- Outperform the stock market

- Low volatility growth curve

Invest in the biggest and highest-value distilleries in the industry

Bottles and Casks from these distilleries, as well as rare and limited-edition releases, can command incredibly high prices at auction and are highly sought after by collectors and investors alike.

Discover Whisky Cask Ownership and Investment

How This Works

Purchasing Whisky Casks with Speyside Capital is easy.

- Join our online portal

- Reach out to us

- Receive your tailored Cask portfolio

- Digitally Onboard

- Watch your investment grow

Discover Your Options

Join our Online Learning Portal For Free

- Complimentary 30 Minute Webinar

- Educational Videos

- FAQ's

- Cask Portfolio Examples & Distillery Access

- How This Works